Step-by-step guide on using theDuring this walkthrough, we will become familiar with the mainSimpleExponentialSmoothingOptimized ModelwithStatsforecast.

StatsForecast class and some relevant methods such as

StatsForecast.plot, StatsForecast.forecast and

StatsForecast.cross_validation in other.

The text in this article is largely taken from: 1. Changquan Huang •

Alla Petukhina. Springer series (2022). Applied Time Series Analysis and

Forecasting with

Python. 2.

Ivan Svetunkov. Forecasting and Analytics with the Augmented Dynamic

Adaptive Model (ADAM) 3. James D.

Hamilton. Time Series Analysis Princeton University Press, Princeton,

New Jersey, 1st Edition,

1994.

4. Rob J. Hyndman and George Athanasopoulos (2018). “Forecasting

Principles and Practice (3rd ed)”.

Table of Contents

- Introduction

- Simple Exponential Smoothing Optimized Model

- Loading libraries and data

- Explore data with the plot method

- Split the data into training and testing

- Implementation of SimpleExponentialSmoothingOptimized with StatsForecast

- Cross-validation

- Model evaluation

- References

Introduction

Simple Exponential Smoothing Optimized (SES Optimized) is a forecasting model used to predict future values in univariate time series. It is a variant of the simple exponential smoothing (SES) method that uses an optimization approach to estimate the model parameters more accurately. The SES Optimized method uses a single smoothing parameter to estimate the trend and seasonality in the time series data. The model attempts to minimize the mean squared error (MSE) between the predictions and the actual values in the training sample using an optimization algorithm. The SES Optimized approach is especially useful for time series with strong trend and seasonality patterns, or for time series with noisy data. However, it is important to note that this model assumes that the time series is stationary and that the variation in the data is random and there are no non-random patterns in the data. If these assumptions are not met, the SES Optimized model may not perform well and another forecasting method may be required.Simple Exponential Smoothing Model

The simplest of the exponentially smoothing methods is naturally called simple exponential smoothing (SES). This method is suitable for forecasting data with no clear trend or seasonal pattern. Using the naïve method, all forecasts for the future are equal to the last observed value of the series, for . Hence, the naïve method assumes that the most recent observation is the only important one, and all previous observations provide no information for the future. This can be thought of as a weighted average where all of the weight is given to the last observation. Using the average method, all future forecasts are equal to a simple average of the observed data, for Hence, the average method assumes that all observations are of equal importance, and gives them equal weights when generating forecasts. We often want something between these two extremes. For example, it may be sensible to attach larger weights to more recent observations than to observations from the distant past. This is exactly the concept behind simple exponential smoothing. Forecasts are calculated using weighted averages, where the weights decrease exponentially as observations come from further in the past — the smallest weights are associated with the oldest observations: where is the smoothing parameter. The one-step-ahead forecast for time is a weighted average of all of the observations in the series . The rate at which the weights decrease is controlled by the parameter . For any between 0 and 1, the weights attached to the observations decrease exponentially as we go back in time, hence the name “exponential smoothing”. If is small (i.e., close to 0), more weight is given to observations from the more distant past. If is large (i.e., close to 1), more weight is given to the more recent observations. For the extreme case where , and the forecasts are equal to the naïve forecasts.Optimisation

The application of every exponential smoothing method requires the smoothing parameters and the initial values to be chosen. In particular, for simple exponential smoothing, we need to select the values of and . All forecasts can be computed from the data once we know those values. For the methods that follow there is usually more than one smoothing parameter and more than one initial component to be chosen. In some cases, the smoothing parameters may be chosen in a subjective manner — the forecaster specifies the value of the smoothing parameters based on previous experience. However, a more reliable and objective way to obtain values for the unknown parameters is to estimate them from the observed data. From regression models we estimated the coefficients of a regression model by minimising the sum of the squared residuals (usually known as SSE or “sum of squared errors”). Similarly, the unknown parameters and the initial values for any exponential smoothing method can be estimated by minimising the SSE. The residuals are specified as for . Hence, we find the values of the unknown parameters and the initial values that minimise Unlike the regression case (where we have formulas which return the values of the regression coefficients that minimise the SSE), this involves a non-linear minimisation problem, and we need to use an optimisation tool to solve it.Loading libraries and data

Tip Statsforecast will be needed. To install, see instructions.Next, we import plotting libraries and configure the plotting style.

Read Data

| Time | Ads | |

|---|---|---|

| 0 | 2017-09-13T00:00:00 | 80115 |

| 1 | 2017-09-13T01:00:00 | 79885 |

| 2 | 2017-09-13T02:00:00 | 89325 |

| 3 | 2017-09-13T03:00:00 | 101930 |

| 4 | 2017-09-13T04:00:00 | 121630 |

-

The

unique_id(string, int or category) represents an identifier for the series. -

The

ds(datestamp) column should be of a format expected by Pandas, ideally YYYY-MM-DD for a date or YYYY-MM-DD HH:MM:SS for a timestamp. -

The

y(numeric) represents the measurement we wish to forecast.

| ds | y | unique_id | |

|---|---|---|---|

| 0 | 2017-09-13T00:00:00 | 80115 | 1 |

| 1 | 2017-09-13T01:00:00 | 79885 | 1 |

| 2 | 2017-09-13T02:00:00 | 89325 | 1 |

| 3 | 2017-09-13T03:00:00 | 101930 | 1 |

| 4 | 2017-09-13T04:00:00 | 121630 | 1 |

(ds) is in an object format, we need

to convert to a date format

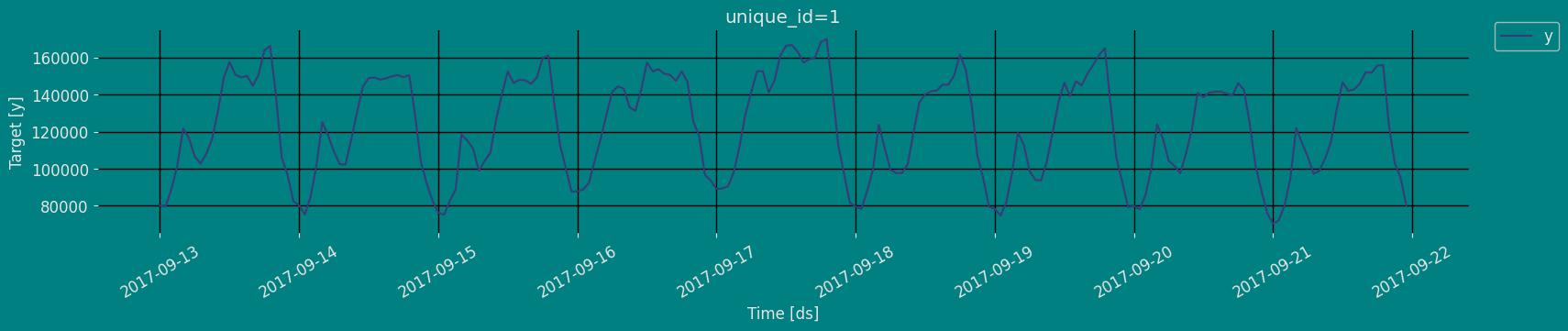

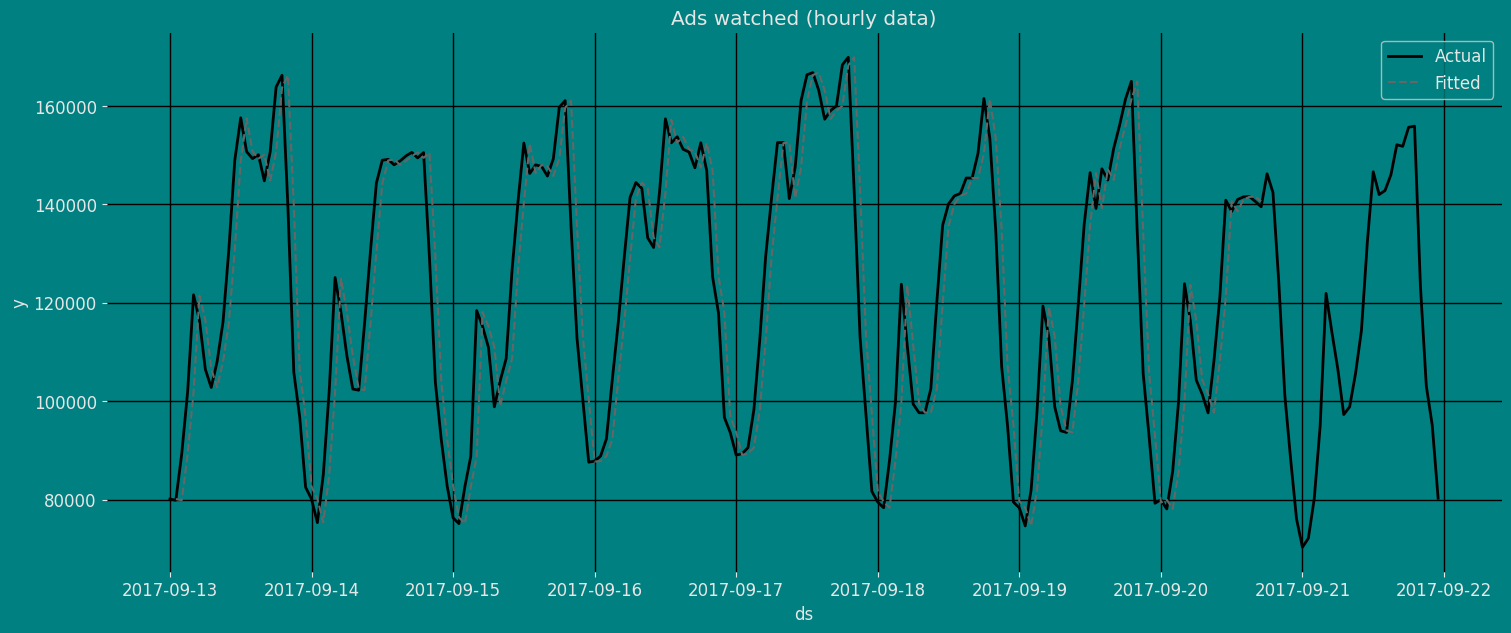

Explore Data with the plot method

Plot some series using the plot method from the StatsForecast class. This method prints a random series from the dataset and is useful for basic EDA.

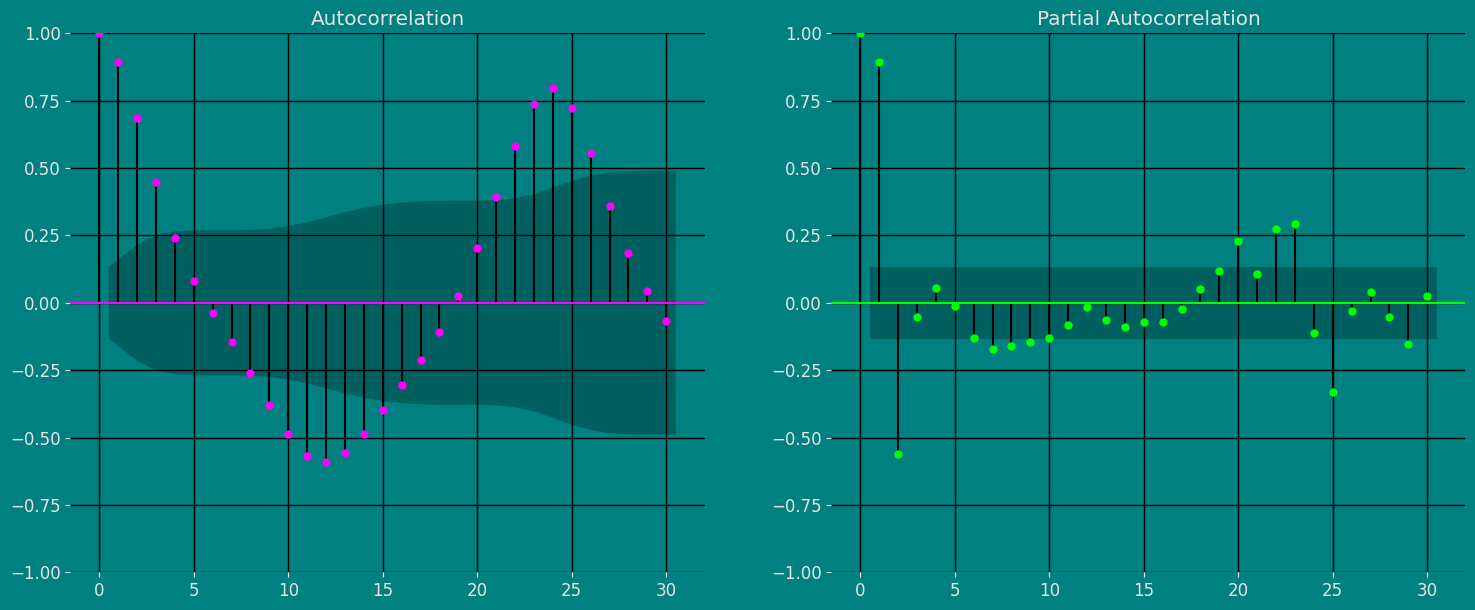

Autocorrelation plots

Split the data into training and testing

Let’s divide our data into sets- Data to train our

Simple Exponential Smoothing Optimized Model - Data to test our model

Implementation of SimpleExponentialSmoothingOptimized with StatsForecast

Load libraries

Instantiating Model

-

freq:a string indicating the frequency of the data. (See panda’s available frequencies.) -

n_jobs:n_jobs: int, number of jobs used in the parallel processing, use -1 for all cores. -

fallback_model:a model to be used if a model fails.

Fit the Model

Simple Exponential Smoothing Optimized model. We can observe it with

the following instruction:

.get() function to extract the element and then we are going to save

it in a pd.DataFrame().

| fitted | ds | |

|---|---|---|

| 0 | NaN | 2017-09-13 00:00:00 |

| 1 | 80115.000000 | 2017-09-13 01:00:00 |

| 2 | 79887.296875 | 2017-09-13 02:00:00 |

| … | … | … |

| 183 | 141519.406250 | 2017-09-20 15:00:00 |

| 184 | 141589.296875 | 2017-09-20 16:00:00 |

| 185 | 140619.796875 | 2017-09-20 17:00:00 |

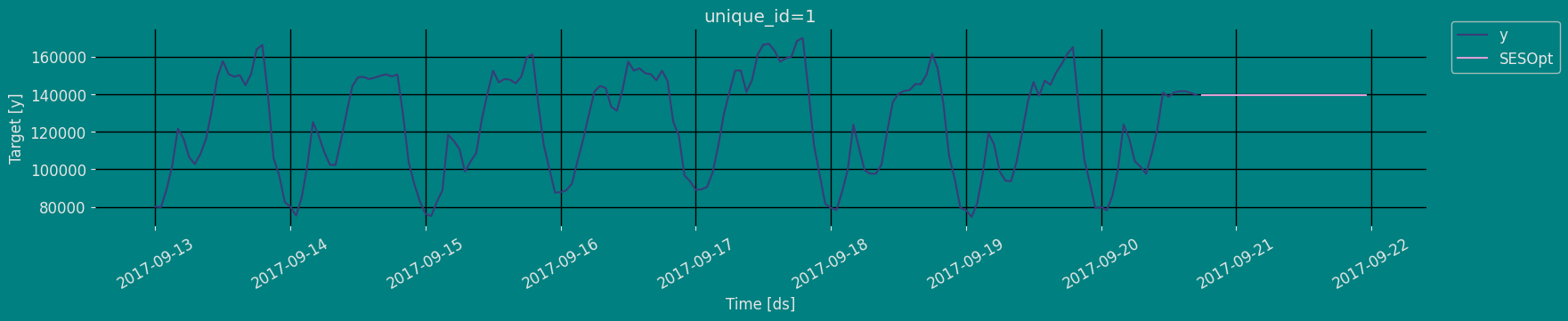

Forecast Method

If you want to gain speed in productive settings where you have multiple series or models we recommend using theStatsForecast.forecast method

instead of .fit and .predict.

The main difference is that the .forecast doest not store the fitted

values and is highly scalable in distributed environments.

The forecast method takes two arguments: forecasts next h (horizon)

and level.

h (int):represents the forecast h steps into the future. In this case, 30 hors ahead.

| unique_id | ds | SESOpt | |

|---|---|---|---|

| 0 | 1 | 2017-09-20 18:00:00 | 139526.046875 |

| 1 | 1 | 2017-09-20 19:00:00 | 139526.046875 |

| 2 | 1 | 2017-09-20 20:00:00 | 139526.046875 |

| … | … | … | … |

| 27 | 1 | 2017-09-21 21:00:00 | 139526.046875 |

| 28 | 1 | 2017-09-21 22:00:00 | 139526.046875 |

| 29 | 1 | 2017-09-21 23:00:00 | 139526.046875 |

| unique_id | ds | y | SESOpt | |

|---|---|---|---|---|

| 0 | 1 | 2017-09-13 00:00:00 | 80115.0 | NaN |

| 1 | 1 | 2017-09-13 01:00:00 | 79885.0 | 80115.000000 |

| 2 | 1 | 2017-09-13 02:00:00 | 89325.0 | 79887.296875 |

| 3 | 1 | 2017-09-13 03:00:00 | 101930.0 | 89230.625000 |

| 4 | 1 | 2017-09-13 04:00:00 | 121630.0 | 101803.007812 |

Predict method with confidence interval

To generate forecasts use the predict method. The predict method takes two arguments: forecasts the nexth (for

horizon) and level.

h (int):represents the forecast h steps into the future. In this case, 30 hours ahead.

| unique_id | ds | SESOpt | |

|---|---|---|---|

| 0 | 1 | 2017-09-20 18:00:00 | 139526.046875 |

| 1 | 1 | 2017-09-20 19:00:00 | 139526.046875 |

| 2 | 1 | 2017-09-20 20:00:00 | 139526.046875 |

| … | … | … | … |

| 27 | 1 | 2017-09-21 21:00:00 | 139526.046875 |

| 28 | 1 | 2017-09-21 22:00:00 | 139526.046875 |

| 29 | 1 | 2017-09-21 23:00:00 | 139526.046875 |

Cross-validation

In previous steps, we’ve taken our historical data to predict the future. However, to asses its accuracy we would also like to know how the model would have performed in the past. To assess the accuracy and robustness of your models on your data perform Cross-Validation. With time series data, Cross Validation is done by defining a sliding window across the historical data and predicting the period following it. This form of cross-validation allows us to arrive at a better estimation of our model’s predictive abilities across a wider range of temporal instances while also keeping the data in the training set contiguous as is required by our models. The following graph depicts such a Cross Validation Strategy:

Perform time series cross-validation

Cross-validation of time series models is considered a best practice but most implementations are very slow. The statsforecast library implements cross-validation as a distributed operation, making the process less time-consuming to perform. If you have big datasets you can also perform Cross Validation in a distributed cluster using Ray, Dask or Spark. In this case, we want to evaluate the performance of each model for the last 5 months(n_windows=), forecasting every second months

(step_size=12). Depending on your computer, this step should take

around 1 min.

The cross_validation method from the StatsForecast class takes the

following arguments.

-

df:training data frame -

h (int):represents h steps into the future that are being forecasted. In this case, 30 hours ahead. -

step_size (int):step size between each window. In other words: how often do you want to run the forecasting processes. -

n_windows(int):number of windows used for cross validation. In other words: what number of forecasting processes in the past do you want to evaluate.

unique_id:index. If you dont like working with index just runcrossvalidation_df.resetindex().ds:datestamp or temporal indexcutoff:the last datestamp or temporal index for then_windows.y:true valuemodel:columns with the model’s name and fitted value.

| unique_id | ds | cutoff | y | SESOpt | |

|---|---|---|---|---|---|

| 0 | 1 | 2017-09-18 06:00:00 | 2017-09-18 05:00:00 | 99440.0 | 111447.140625 |

| 1 | 1 | 2017-09-18 07:00:00 | 2017-09-18 05:00:00 | 97655.0 | 111447.140625 |

| 2 | 1 | 2017-09-18 08:00:00 | 2017-09-18 05:00:00 | 97655.0 | 111447.140625 |

| … | … | … | … | … | … |

| 87 | 1 | 2017-09-21 21:00:00 | 2017-09-20 17:00:00 | 103080.0 | 139526.046875 |

| 88 | 1 | 2017-09-21 22:00:00 | 2017-09-20 17:00:00 | 95155.0 | 139526.046875 |

| 89 | 1 | 2017-09-21 23:00:00 | 2017-09-20 17:00:00 | 80285.0 | 139526.046875 |

Model Evaluation

Now we are going to evaluate our model with the results of the predictions, we will use different types of metrics MAE, MAPE, MASE, RMSE, SMAPE to evaluate the accuracy.| unique_id | metric | SESOpt | |

|---|---|---|---|

| 0 | 1 | mae | 29230.182292 |

| 1 | 1 | mape | 0.314203 |

| 2 | 1 | mase | 3.611444 |

| 3 | 1 | rmse | 35866.963426 |

| 4 | 1 | smape | 0.124271 |

References

- Changquan Huang • Alla Petukhina. Springer series (2022). Applied Time Series Analysis and Forecasting with Python.

- Ivan Svetunkov. Forecasting and Analytics with the Augmented Dynamic Adaptive Model (ADAM)

- James D. Hamilton. Time Series Analysis Princeton University Press, Princeton, New Jersey, 1st Edition, 1994.

- Nixtla SeasonalExponentialOptimized API

- Pandas available frequencies.

- Rob J. Hyndman and George Athanasopoulos (2018). “Forecasting Principles and Practice (3rd ed)”.

- Seasonal periods- Rob J Hyndman.