Step-by-step guide on using theDuring this walkthrough, we will become familiar with the mainCrostonSBA ModelwithStatsforecast.

StatsForecast class and some relevant methods such as

StatsForecast.plot, StatsForecast.forecast and

StatsForecast.cross_validation in other.

The text in this article is largely taken from: 1. Changquan Huang •

Alla Petukhina. Springer series (2022). Applied Time Series Analysis and

Forecasting with

Python. 2.

Ivan Svetunkov. Forecasting and Analytics with the Augmented Dynamic

Adaptive Model (ADAM) 3. James D.

Hamilton. Time Series Analysis Princeton University Press, Princeton,

New Jersey, 1st Edition,

1994.

4. Rob J. Hyndman and George Athanasopoulos (2018). “Forecasting

Principles and Practice (3rd ed)”.

Table of Contents

- Introduction

- Croston SBA Model

- Loading libraries and data

- Explore data with the plot method

- Split the data into training and testing

- Implementation of CrostonSBA with StatsForecast

- Cross-validation

- Model evaluation

- References

Introduction

The Croston model is a method used to forecast time series with intermittent demand data, that is, data that has many periods of zero demand and only a few periods of non-zero demand. Croston’s approach was originally proposed by J.D. Croston in 1972. Subsequently, Syntetos and Boylan proposed an improvement to the original model in 2001, known as the Croston-SBA (Syntetos and Boylan Approximation). The Croston-SBA model is based on the assumption that intermittent demand follows a binomial process. Instead of directly modeling demand, the focus is on modeling the intervals between demand periods. The model has two main components: one to model the intervals between demand periods (which are assumed to follow a Poisson distribution), and another to model the demands when they occur. It is important to note that the Croston-SBA model assumes that the intervals between the non-zero demand periods are independent and follow a Poisson distribution. However, this model is an approximation and may not work well in all situations. It is advisable to evaluate its performance on historical data before using it in practice.Croston SBA Model

The formula of SBA is very similar to the original Croston’s method, however, it apply a correction factor which reduce the error in the final estimate result. if then Otherwise where- Average demand per period

- Actual demand at period

- Time between two positive demand

- Demand size forecast for next period

- Forecast of demand interval

- Smoothing constant

Principals of the Croston SBA method

The Croston SBA (Syntetos and Boylan Approximate) method is a technique used for forecasting time series with intermittent or sporadic data. This methodology is based on the original Croston method, which was developed to forecast inventory demand in situations where data is sparse or not available at regular intervals. The main properties of the Croston SBA method are the following:- Suitable for intermittent data: The Croston SBA method is especially useful when the data exhibits intermittent patterns, that is, periods of demand followed by periods of non-demand. Instead of treating the data as zero for non-demand periods, the Croston SBA method estimates demand occurrence rates and conditional demand rates.

- Separation of frequency and level: One of the key features of the Croston SBA method is that it separates the frequency and level information in the demand data. This allows these two components to be modeled and forecasted separately, which can result in better predictions.

- Estimation of occurrence and demand rates: The Croston SBA method uses a simple exponential smoothing technique to estimate conditional occurrence and demand rates. These rates are then used to forecast future demand.

- Does not assume distribution of the data: Unlike some forecasting techniques that assume a specific distribution of the data, the Croston SBA method makes no assumptions about the distribution of demand. This makes it more flexible and applicable to a wide range of situations.

- Does not require complete historical data: The Croston SBA method can work even when historical data is sparse or not available at regular intervals. This makes it an attractive option when it comes to forecasting intermittent demand with limited data.

Loading libraries and data

Tip Statsforecast will be needed. To install, see instructions.Next, we import plotting libraries and configure the plotting style.

| date | sales | |

|---|---|---|

| 0 | 2022-01-01 00:00:00 | 0 |

| 1 | 2022-01-01 01:00:00 | 10 |

| 2 | 2022-01-01 02:00:00 | 0 |

| 3 | 2022-01-01 03:00:00 | 0 |

| 4 | 2022-01-01 04:00:00 | 100 |

-

The

unique_id(string, int or category) represents an identifier for the series. -

The

ds(datestamp) column should be of a format expected by Pandas, ideally YYYY-MM-DD for a date or YYYY-MM-DD HH:MM:SS for a timestamp. -

The

y(numeric) represents the measurement we wish to forecast.

| ds | y | unique_id | |

|---|---|---|---|

| 0 | 2022-01-01 00:00:00 | 0 | 1 |

| 1 | 2022-01-01 01:00:00 | 10 | 1 |

| 2 | 2022-01-01 02:00:00 | 0 | 1 |

| 3 | 2022-01-01 03:00:00 | 0 | 1 |

| 4 | 2022-01-01 04:00:00 | 100 | 1 |

(ds) is in an object format, we need

to convert to a date format

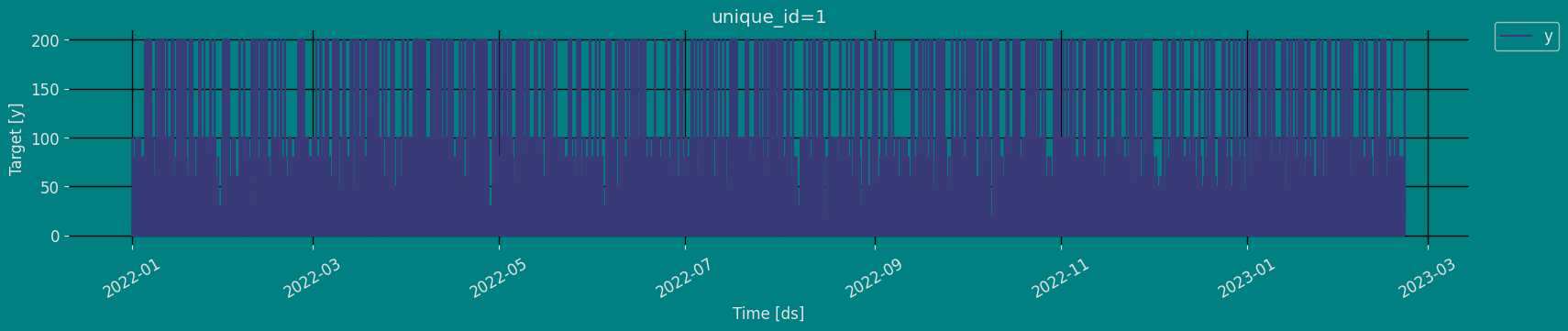

Explore Data with the plot method

Plot some series using the plot method from the StatsForecast class. This method prints a random series from the dataset and is useful for basic EDA.

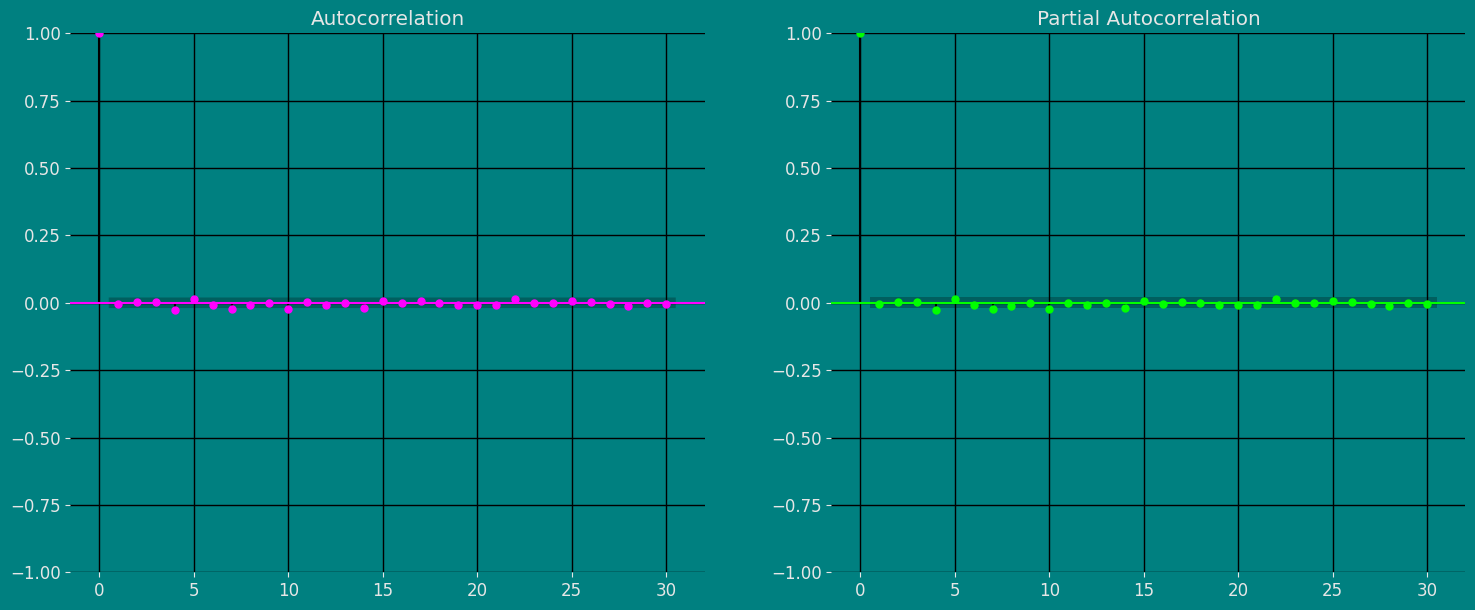

Autocorrelation plots

Autocorrelation (ACF) and partial autocorrelation (PACF) plots are statistical tools used to analyze time series. ACF charts show the correlation between the values of a time series and their lagged values, while PACF charts show the correlation between the values of a time series and their lagged values, after the effect of previous lagged values has been removed. ACF and PACF charts can be used to identify the structure of a time series, which can be helpful in choosing a suitable model for the time series. For example, if the ACF chart shows a repeating peak and valley pattern, this indicates that the time series is stationary, meaning that it has the same statistical properties over time. If the PACF chart shows a pattern of rapidly decreasing spikes, this indicates that the time series is invertible, meaning it can be reversed to get a stationary time series. The importance of the ACF and PACF charts is that they can help analysts better understand the structure of a time series. This understanding can be helpful in choosing a suitable model for the time series, which can improve the ability to predict future values of the time series. To analyze ACF and PACF charts:- Look for patterns in charts. Common patterns include repeating peaks and valleys, sawtooth patterns, and plateau patterns.

- Compare ACF and PACF charts. The PACF chart generally has fewer spikes than the ACF chart.

- Consider the length of the time series. ACF and PACF charts for longer time series will have more spikes.

- Use a confidence interval. The ACF and PACF plots also show confidence intervals for the autocorrelation values. If an autocorrelation value is outside the confidence interval, it is likely to be significant.

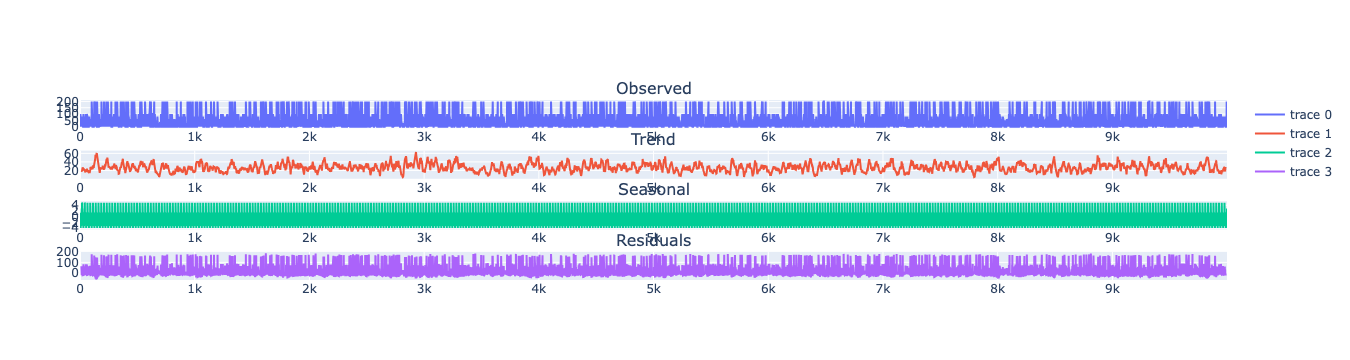

Decomposition of the time series

How to decompose a time series and why? In time series analysis to forecast new values, it is very important to know past data. More formally, we can say that it is very important to know the patterns that values follow over time. There can be many reasons that cause our forecast values to fall in the wrong direction. Basically, a time series consists of four components. The variation of those components causes the change in the pattern of the time series. These components are:- Level: This is the primary value that averages over time.

- Trend: The trend is the value that causes increasing or decreasing patterns in a time series.

- Seasonality: This is a cyclical event that occurs in a time series for a short time and causes short-term increasing or decreasing patterns in a time series.

- Residual/Noise: These are the random variations in the time series.

Additive time series

If the components of the time series are added to make the time series. Then the time series is called the additive time series. By visualization, we can say that the time series is additive if the increasing or decreasing pattern of the time series is similar throughout the series. The mathematical function of any additive time series can be represented by:Multiplicative time series

If the components of the time series are multiplicative together, then the time series is called a multiplicative time series. For visualization, if the time series is having exponential growth or decline with time, then the time series can be considered as the multiplicative time series. The mathematical function of the multiplicative time series can be represented as.

Split the data into training and testing

Let’s divide our data into sets 1. Data to train ourCroston SBA Model. 2. Data to test our model

For the test data we will use the last 500 Hours to test and evaluate

the performance of our model.

Implementation of CrostonSBA with StatsForecast

Load libraries

Instantiating Model

Import and instantiate the models. Setting the argument is sometimes tricky. This article on Seasonal periods by the master, Rob Hyndmann, can be useful forseason_length.

-

freq:a string indicating the frequency of the data. (See pandas’ available frequencies.) -

n_jobs:n_jobs: int, number of jobs used in the parallel processing, use -1 for all cores. -

fallback_model:a model to be used if a model fails.

Fit the Model

Croston SBA Model. We can observe it with

the following instruction:

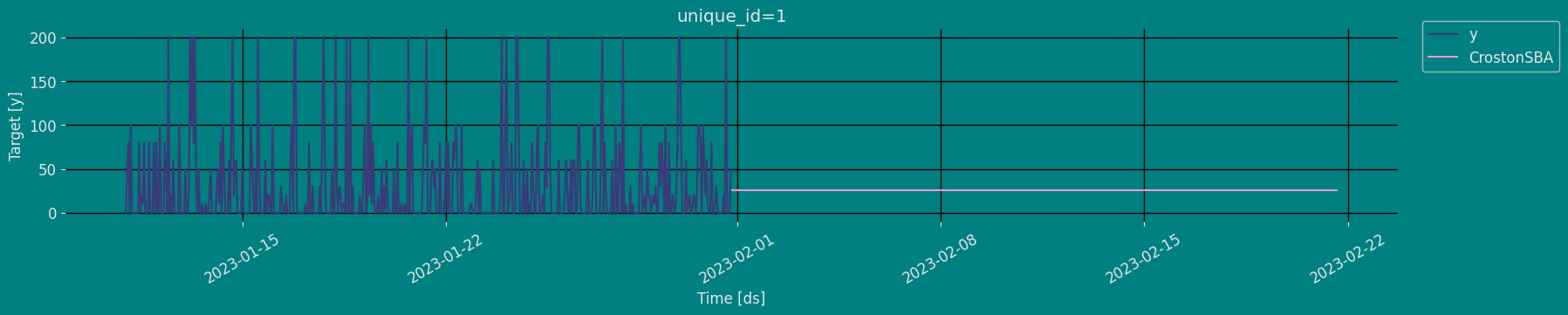

Forecast Method

If you want to gain speed in productive settings where you have multiple series or models we recommend using theStatsForecast.forecast method

instead of .fit and .predict.

The main difference is that the .forecast doest not store the fitted

values and is highly scalable in distributed environments.

The forecast method takes two arguments: forecasts next h (horizon)

and level.

h (int):represents the forecast h steps into the future. In this case, 500 hours ahead.

ARIMA and Theta)

| unique_id | ds | CrostonSBA | |

|---|---|---|---|

| 0 | 1 | 2023-01-31 20:00:00 | 26.047497 |

| 1 | 1 | 2023-01-31 21:00:00 | 26.047497 |

| 2 | 1 | 2023-01-31 22:00:00 | 26.047497 |

| … | … | … | … |

| 497 | 1 | 2023-02-21 13:00:00 | 26.047497 |

| 498 | 1 | 2023-02-21 14:00:00 | 26.047497 |

| 499 | 1 | 2023-02-21 15:00:00 | 26.047497 |

Predict method with confidence interval

To generate forecasts use the predict method. The predict method takes two arguments: forecasts the nexth (for

horizon) and level.

h (int):represents the forecast h steps into the future. In this case, 500 hours ahead.

| unique_id | ds | CrostonSBA | |

|---|---|---|---|

| 0 | 1 | 2023-01-31 20:00:00 | 26.047497 |

| 1 | 1 | 2023-01-31 21:00:00 | 26.047497 |

| 2 | 1 | 2023-01-31 22:00:00 | 26.047497 |

| … | … | … | … |

| 497 | 1 | 2023-02-21 13:00:00 | 26.047497 |

| 498 | 1 | 2023-02-21 14:00:00 | 26.047497 |

| 499 | 1 | 2023-02-21 15:00:00 | 26.047497 |

Cross-validation

In previous steps, we’ve taken our historical data to predict the future. However, to asses its accuracy we would also like to know how the model would have performed in the past. To assess the accuracy and robustness of your models on your data perform Cross-Validation. With time series data, Cross Validation is done by defining a sliding window across the historical data and predicting the period following it. This form of cross-validation allows us to arrive at a better estimation of our model’s predictive abilities across a wider range of temporal instances while also keeping the data in the training set contiguous as is required by our models. The following graph depicts such a Cross Validation Strategy:

Perform time series cross-validation

Cross-validation of time series models is considered a best practice but most implementations are very slow. The statsforecast library implements cross-validation as a distributed operation, making the process less time-consuming to perform. If you have big datasets you can also perform Cross Validation in a distributed cluster using Ray, Dask or Spark. In this case, we want to evaluate the performance of each model for the last 5 months(n_windows=), forecasting every second months

(step_size=50). Depending on your computer, this step should take

around 1 min.

The cross_validation method from the StatsForecast class takes the

following arguments.

-

df:training data frame -

h (int):represents h steps into the future that are being forecasted. In this case, 500 hours ahead. -

step_size (int):step size between each window. In other words: how often do you want to run the forecasting processes. -

n_windows(int):number of windows used for cross validation. In other words: what number of forecasting processes in the past do you want to evaluate.

unique_id:series identifierds:datestamp or temporal indexcutoff:the last datestamp or temporal index for then_windows.y:true valuemodel:columns with the model’s name and fitted value.

| unique_id | ds | cutoff | y | CrostonSBA | |

|---|---|---|---|---|---|

| 0 | 1 | 2023-01-23 12:00:00 | 2023-01-23 11:00:00 | 0.0 | 22.473040 |

| 1 | 1 | 2023-01-23 13:00:00 | 2023-01-23 11:00:00 | 0.0 | 22.473040 |

| 2 | 1 | 2023-01-23 14:00:00 | 2023-01-23 11:00:00 | 0.0 | 22.473040 |

| … | … | … | … | … | … |

| 2497 | 1 | 2023-02-21 13:00:00 | 2023-01-31 19:00:00 | 60.0 | 26.047497 |

| 2498 | 1 | 2023-02-21 14:00:00 | 2023-01-31 19:00:00 | 20.0 | 26.047497 |

| 2499 | 1 | 2023-02-21 15:00:00 | 2023-01-31 19:00:00 | 20.0 | 26.047497 |

Model Evaluation

Now we are going to evaluate our model with the results of the predictions, we will use different types of metrics MAE, MAPE, MASE, RMSE, SMAPE to evaluate the accuracy.| unique_id | metric | CrostonSBA | |

|---|---|---|---|

| 0 | 1 | mae | 33.112519 |

| 1 | 1 | mape | 0.626900 |

| 2 | 1 | mase | 0.789945 |

| 3 | 1 | rmse | 45.203519 |

| 4 | 1 | smape | 0.771529 |

References

- Changquan Huang • Alla Petukhina. Springer series (2022). Applied Time Series Analysis and Forecasting with Python.

- Ivan Svetunkov. Forecasting and Analytics with the Augmented Dynamic Adaptive Model (ADAM)

- James D. Hamilton. Time Series Analysis Princeton University Press, Princeton, New Jersey, 1st Edition, 1994.

- Nixtla CrostonSBA API

- Pandas available frequencies.

- Rob J. Hyndman and George Athanasopoulos (2018). “Forecasting Principles and Practice (3rd ed)”.

- Seasonal periods- Rob J Hyndman.